Equities - rates, eligibility, availability of relief etc. - Hungary

Reference

Withholding Tax

| Holding restrictions a | Yes |

Standard rate on equities | 15% b |

---------------------

a. Applicable to Hungarian individuals holding non-listed Hungarian equities.

b. Before January 2016, the standard withholding tax rate on Hungarian equities was 16%.

Eligible beneficial owners

| Relief at source | Quick refund a | Standard refund | |

| Individuals resident of Double Taxation Treaty (DTT) countries | Yes | No | Yes |

| Legal entities not resident in Hungary | Yes | Yes | Yes |

| Legal entities resident in Hungary | Yes | Yes | No |

| Individuals resident in Hungary | No | No | No |

--------------------

a. Quick refund of withholding tax is only available if the issuer agrees to revise their declaration to the Hungarian Tax Authorities.

Availability of relief

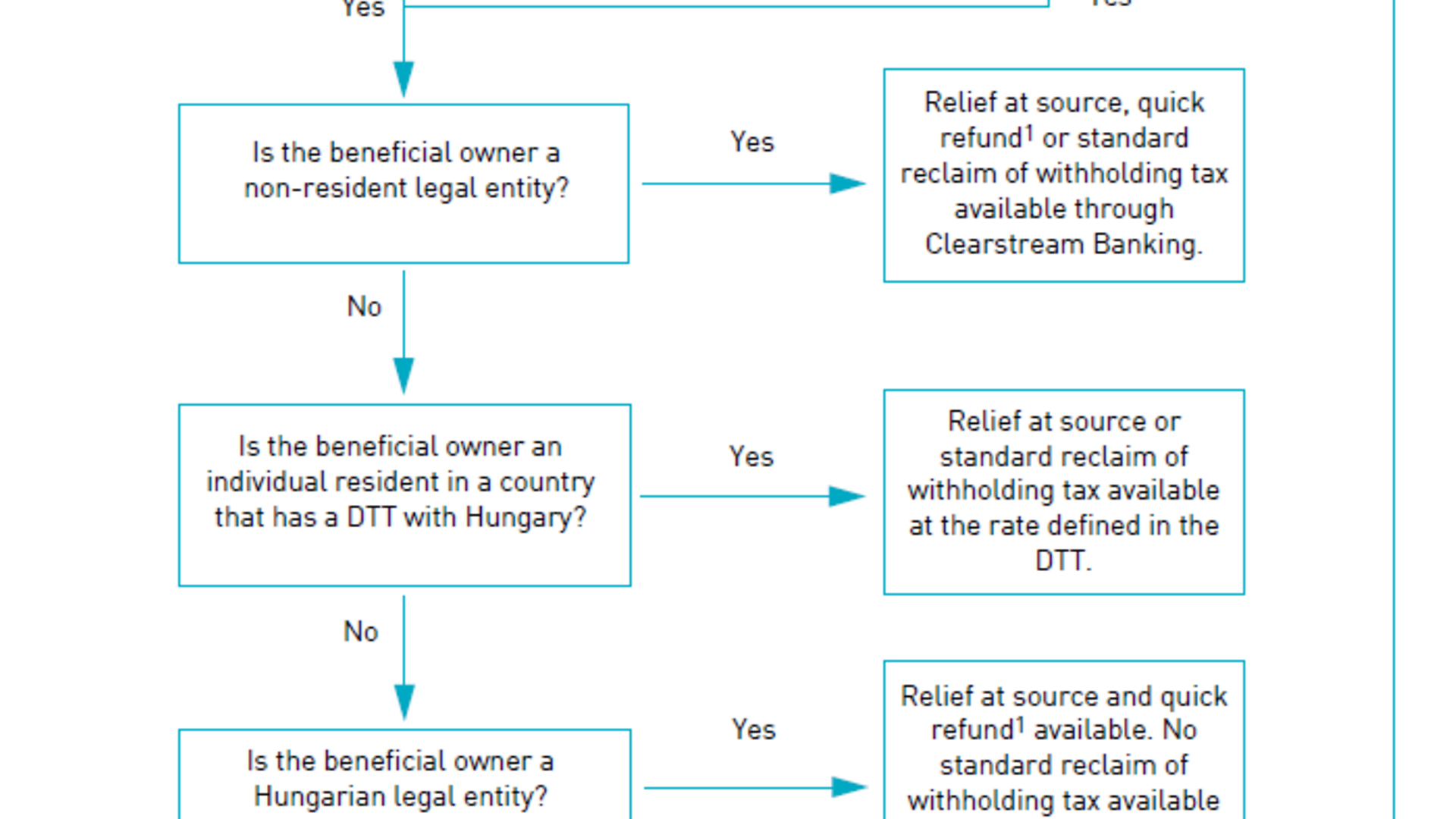

Depending on their residency and status, relief of withholding tax is available to eligible beneficial owners through Clearstream by means of relief at source, quick refund or standard refund procedures, as described in the following sections.

Click on the image for a larger view of the diagram showing the availability of relief at source and/or reclaim on withholding tax on income from Hungarian equities.