Form descriptions - Germany

Information is provided here about the forms and their use in relation to the procedure for standard refund of withholding tax on income from German securities.

The documentation requirements are as follows:

- Application for a refund of German capital income tax;

- Power of Attorney;

- One-Time Client Declaration (OTCD) to request German Tax Vouchers;

- Tax Voucher for convertible bonds, certificates and profit participating certificates since 1 January 2013 and for dividend and fund distributions (including those for growth funds or accumulation funds) since 1 January 2012);

- Credit Advice (for convertible bonds, certificates and profit participating certificates up to 31 December 2012 and for dividend and fund distributions (including those for growth funds or accumulation funds) up to 31 December 2011);

- Letter of Request to Clearstream Banking for Reclaim of German Withholding Tax;

- Fund Status Certificate;

PDFs of the Clearstream Banking forms are available under Tax forms to use - Germany

Application for a refund of German capital income tax

The Application forms for a refund of German capital income tax are available on the website of the Federal Central Tax Office (Bundeszentralamt für Steuern; BZSt) and must be completed online.

To access the correct form, the beneficial owner or client under Power of Attorney must:

1. Go to the BZSt website via the above-mentioned link.

2. Select “Refund Forms”

3. Select the appropriate form for your refund request from the list of available forms.

How to fill the form

For detailed information on how to complete the application form, please refer to the information on BZSt website.

The example below (“Application for refund of German capital income tax (de/en)”) provides guidance to fill the reclaim form via Clearstream Banking and not directly to the BZSt. How to complete the different chapters of the refund form is to be understood as an example, without our liability on completeness and accuracy.

- When you select the refund request form, change the language to English if applicable; then

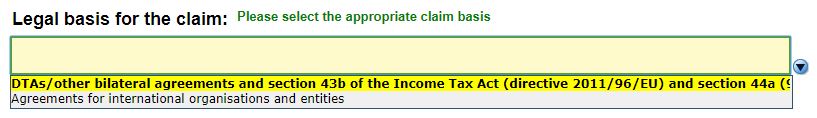

- Select the Legal basis for the claim.

Depending on whether the Legal basis for the claim is “DTAs/other bilateral agreements and section 43b of the Income Tax Act (directive 2011/96/EU) and section 44a (9) of the Income Tax Act” or “Agreements for international organisations and entities”, different questions must be answered in the form. For "DTAs/other bilateral agreements and section 43b of the Income Tax Act (directive 2011/96/EU) and section 44a (9) of the Income Tax Act", the beneficial owner or client under Power of Attorney must select before completing the form:

- Country/territory;

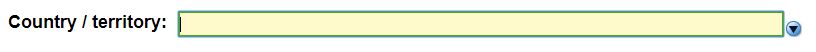

- Applicant's legal form.

Once all the required information has been completed online, the beneficial owner or client under Power of Attorney must print out and sign the form.

Clients should note that corrections on the form are not allowed.

Box I. Applicant (= creditor of the capital income)

Beneficial owners or clients under Power of Attorney must complete the requested information.

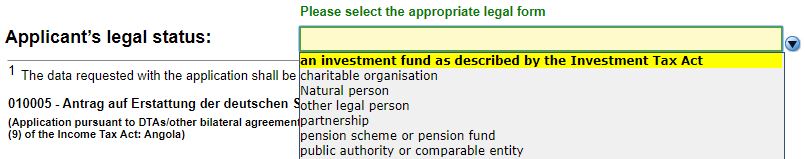

Box II. Authorised representative

Important note: If beneficial owners or clients under Power of Attorney wish to send the reclaim form via Clearstream Banking and not directly to BZSt, the following data must be completed in Box II.

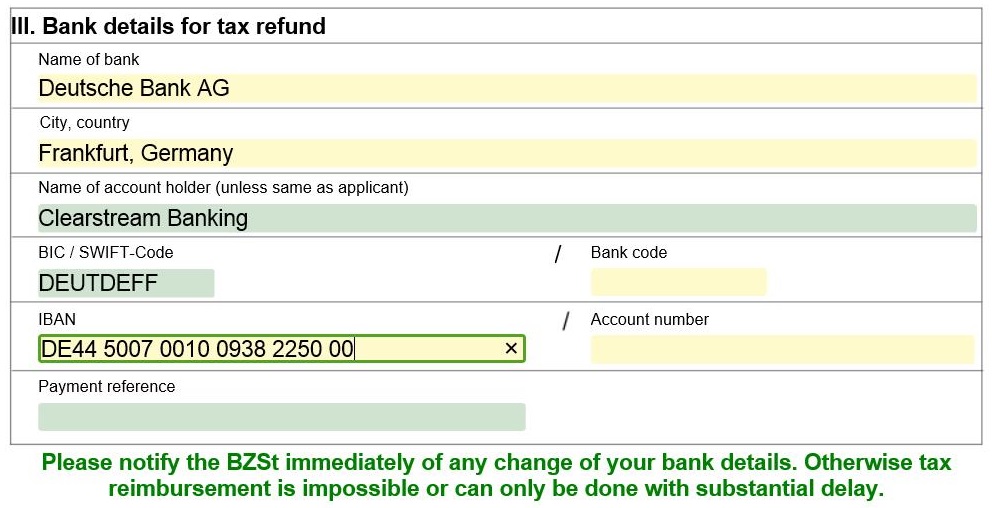

Box III. Bank details for tax refund

Important note: If beneficial owners or clients under Power of Attorney wish to send the reclaim form via Clearstream Banking and not directly to BZSt, the following data must be completed in Box III.

Box IV. General information

Beneficial owners or clients under Power of Attorney must answer all relevant questions.

Clearstream Banking can only check if each question has a checkmark.

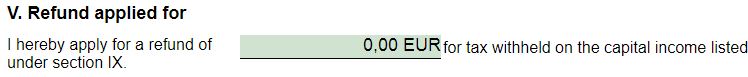

Box V. Refund applied for

This field automatically uses the total sum from Box IX on the next page.

Box VI. Declaration of honour

Beneficial owners or clients with a Power of Attorney must complete and sign this box.

If the client or a third party is completing the form on behalf of the beneficial owner, a Power of Attorney must be provided. There is no formal requirement for a Power of Attorney.

Box VII. Certification by the tax authority of the applicant's country of residence/ establishment

This box must be completed by the foreign tax authority and the "Certificate of Residence" must always be stamped and signed on the form.

Box VIII. Documentation and information generally required for processing the application

Beneficial owners or clients under Power of Attorney must answer all relevant questions.

Clearstream Banking can only check if each question has a checkmark.

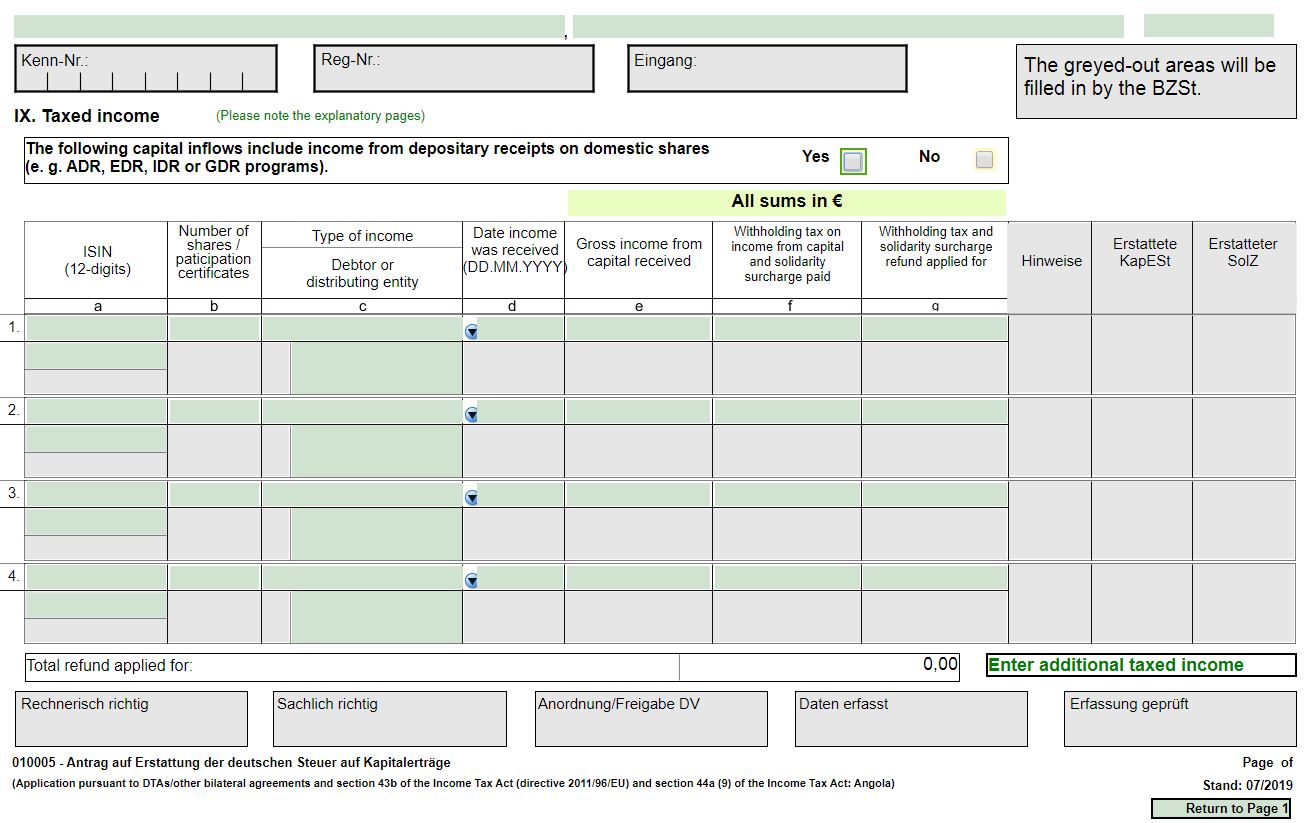

Box IX. Taxed income

Beneficial owners or clients under Power of Attorney must choose if one of the following capital inflows include income from depository receipts on domestic shares.

If yes, then at least one type of income must have selected with "A" (= Income from depository receipts on domestic shares).

The type of income must be selected for each refund listed in the form.

Who completes it? | Beneficial owner or client under Power of Attorney. |

How often is it provided? | Per reclaim application. |

When is it provided? | At the latest, one month before the statutory or Double Taxation Treaty (DTT) deadline, whichever is applicable. |

Copy or original? | Original required. |

Power of Attorney

If the client or a third party is completing the form on behalf of the beneficial owner, a Power of Attorney must be provided.

Who completes it? | Client. |

How often is it provided? | Per reclaim application. |

When is it provided? | At the latest, one month before the statutory or DTT deadline, whichever is applicable. |

Copy or original? | Original required. |

One-Time Client Declaration (OTCD) to request German Tax Vouchers

Before requesting German Tax Vouchers via the BO Upload List application or starting tax reductions instruction based on the German Investment Tax Act (Investmentsteuergesetz; InvStG), clients must first complete the relevant OTCD:

- OTCD Clearstream Banking AG German version;

- OTCD Clearstream Banking AG English version;

- OTCD Clearstream Banking S.A. English version.

The OTCD must then be sent via mail to:

Clearstream Operations Prague s.r.o.

Attn: PTR - Tax Services

Futurama Business Park Building B

Sokolovska 662/136b

18600 Prague 8

Czech Republic

The OTCD needs to be provided on letterhead paper and/or with a company stamp and authorised signatures.

Who completes it? | Client. |

How often is it | Once. Valid until revoked. |

When is it provided? | Before requesting German Tax Vouchers. |

Copy or original? | Original required. |

Request for German Tax Voucher or tax reduction breakdown (upload)

The client can file an application for a single tax voucher (“Einzelsteuerbescheinigung”) with respect to either their own assets or to those of their client. The client can also file an instruction or tax reduction breakdown based on the German Investment Tax Act (Investmentsteuergesetz; InvStG). As of 1 January 2023 tax reductions can only be granted to investment funds that are fully taxable (“unbeschränkt körperschaftsteuerpflichtig”) in Germany and provide the status certificate and tax reduction breakdown within 18 months following the taxable income event.

An application for a German tax voucher or tax reduction breakdown with respect to a Clearstream Banking client’s assets must be made via electronic upload of a data file in the name of the beneficial owner/end-investor of the capital income (see BO Upload application).

Upload processing rejections can be avoided among other by using a dot “." as a separator for shares and fractions. A comma "," should not be used as a separator in your file when ordering German Tax Vouchers. For a full list of guidelines, refer to the German Investment Tax Act (InvStG) web page.

Who completes it? | Client. |

How often is it provided? | Per individual request. |

When is it provided? | Per individual request. |

Copy or original? | Original required. |

Credit Advice

The document is for information only and/or exceptional handling, as tax vouchers must be provided since 2012 or, in some cases, since 2013 in order to start tax reclaim via the BZSt).

Identifies income payment details including the security type, gross amount of payment, date of payment and amount of tax withheld. The credit advice must reconcile with the information in the Claim for Refund of German Withholding Taxes on Dividends and/or Interest.

Who completes it? | Financial institution paying the beneficial owner. |

How often is it provided? | Per reclaim application. |

When is it provided? | At the latest, one month before the statutory or DTT deadline, whichever is applicable. |

Copy or original? | Original required. |

Letter of Request to Clearstream Banking for Reclaim of German Withholding Tax

This authorises Clearstream Banking to reclaim withholding tax from the German Tax Authorities on the client's behalf.

Who completes it? | Client. |

How often is it provided? | Per reclaim application. |

When is it provided? | At the latest, one month before the statutory or DTT deadline, whichever is applicable. |

Copy or original? | Original required. |

Fund Status Certificate

Dividends and similar taxable income in German equities, participation rights and convertible bonds, held by an investment fund company subject to full company tax rate in Germany via a non-German account in Clearstream Banking AG or in general in Clearstream Banking S.A. can be processed by Clearstream Banking at the reduced tax rate of 15% withholding tax, if evidence is provided for classification of the investment fund as a fund pursuant to § 1 InvStG or a special investment fund pursuant to § 53 InvStG. The Fund Status Certificate needs to be provided to Clearstream Banking AG on or before the relevant taxable income payment date. Clients must in addition provide a break down to disclose the fund company (identified by the Ordnungsnummer) and the relevant holdings of the fund company per single income payment to get taxation at a reduced rate of 15% (withholding tax standard rate including solidary surcharge). This per payment information must be provided to Clearstream Banking until 18 months after the record date of the taxable income event latest, using the existing Upload Beneficial Owner List functionality.

A foreign investment fund can reclaim overpaid tax exclusively from the federal central tax office (“BZSt”), a relief at source or quick refund is not available through Clearstream Banking.

The refund procedure pursuant to Section 11 InvStG for foreign investment funds holding a fund status certificate is outlined on the federal central tax office website, please refer hereto for detailed information.

The Fund Status Certificate must be requested from the German Tax Authorities (in most of cases the BZSt).

Who completes it? | The Fund Status Certificate must be requested from the German Tax Authorities (in most of cases the BZSt). |

How often is it provided? | Once, during the period of validity. The Fund Status Certificate is valid three years. |

When is it provided? | Before the relevant taxable income becomes due to be paid. |

Copy or original? | Original required. |