Article: Building the digital future for financial instruments

This article was first published on Finadium.com by Securities Finance Monitor on 27 January 2022.

As an innovative market infrastructure provider, Deutsche Börse Group and Clearstream are paving the way for regulatory compliant, fully digital post-trade transformation. In a guest article for Securities Finance Monitor, Gerd Hartung, Head of Digital Markets and Thomas Wissbach, Senior Vice President in New Digital Markets, discuss the milestones reached and road ahead for the D7 platform as part of this evolution.

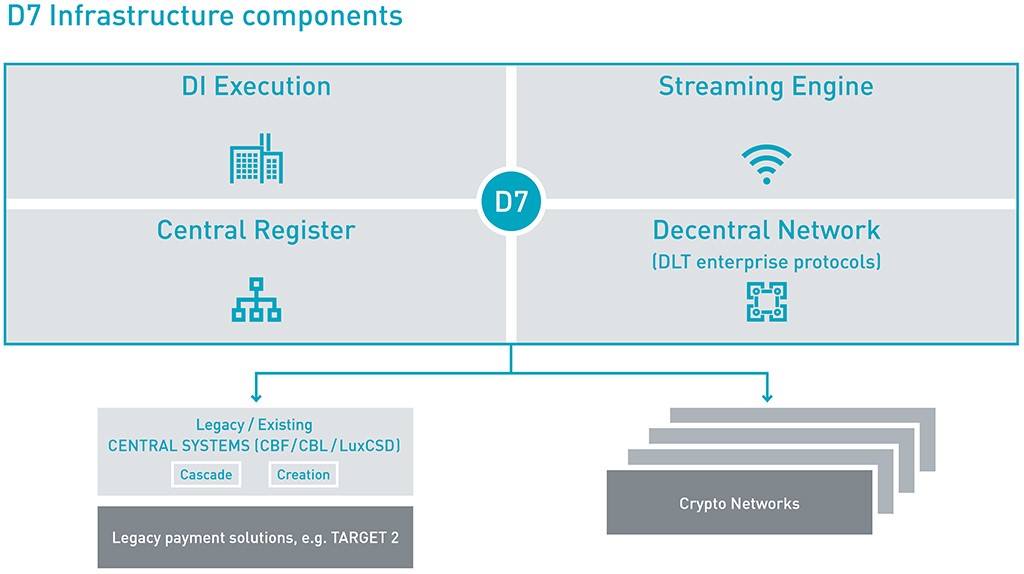

The D7 platform is the new infrastructure component of Deutsche Börse’s “7 Market Technology” series, which covers trading, clearing, settlement and analytics across global networks and various asset classes. Financial institutions will be able to issue, register and process electronic financial instruments on the new platform, which enables the end-to-end processing of the entire life cycle of digital assets.

The digitisation of processes has been a major focus across the financial industry, but one of the core ideas underpinning D7’s development is on the financial instruments themselves. The aim is to create a standard digital description for financial instruments so that there are common, in-sync representations, similar to the music industry using an MP3 format for tracks.

These standard representations will flow through existing regulated environments, such as central securities depositories (CSDs), as well as new environments such as decentralised networks. The digital instrument is the “back bone” which will be used in both worlds, explained Hartung.

In June 2021, Germany’s Electronic Securities Act (eWpG) entered into force, establishing a legal basis for the admission of rights through electronic securities registers, known as a central registry, and adding a new license category for maintaining a crypto securities register.

This law provides much needed certainty for the handling of digitised instruments via traditional structures such as CSDs in the case of the central registry, while crypto registers outline how securities can be managed in the future on a decentralised network, for which there is no need for CSD registration of instruments.

From a technology perspective, these are two parallel worlds that need to be interoperable for issued digital instruments to be able to move between them. From a product perspective, it’s another way of issuing securities in a more convenient way, and how that translates to adoption and products is driven by market participants, said Wissbach.

Market and tech partners

Deutsche Börse’s D7 partners include both market participants and technology solution providers. The financial technology firm Digital Asset is helping to build out the standard representation of digital instruments, while blockchain enterprise software provider R3 and cloud computing and virtualization technology company VMWare are working on the protocols for decentralized networks. The team is also tapping Microsoft for cloud components.

On the market side, there are over a dozen issuers and agents actively involved in building the model, as well as large buy-side institutions joining working groups to understand the process end-to-end.

“We need to understand the complete flow from the issuer, through the whole ecosystem, onto the investor and back,” said Hartung. “And that is why we are having not only issuers and banks around the table, but also end investors.”

Some of the global and German financial institutions signed on include BNP Paribas, Citi, DekaBank, Deutsche Bank, dwpbank, DZ Bank, Goldman Sachs, Raiffeisen Bank International and Vontobel.

Adoption hurdles

The vision for D7 is to be a “major connector” not only for inhouse developments, but also for the proliferation of independent blockchain and DLT-based services, said Wissbach, adding that take-up tends to be spurred by early adopters that push the technology and service options.

One example of an emerging company that can connect to D7 is HQLAᵡ, a platform that enables market participants to transfer ownership of baskets of securities across disparate collateral pools with atomic settlement, and there are also calls to extend this collateral basket lending service to repo transactions.

Participants of DLT-based services will need to become familiar with the operation of network nodes, which are responsible for the accuracy and reliability of storing the entered data in the distributed ledger and have components such as computing resources, ledger, wallet and keys, and protocol applications.

In theory, it’s understood that participants should be more independent running their own nodes on networks, which will provide them more end-to-end flexibility. In practice however, it is not an easy exercise to integrate these network nodes into the existing legacy infrastructure, which requires resources, budgets, business case justification, as well as liability considerations as a node operator.

“We are all conscious that a network, in total, can only be as strong as the weakest node in the network,” said Hartung. “Everyone who operates a node needs to fulfil certain criteria, needs to accept due diligence. And that has a consequence in terms of the service levels that need to be provided and also liabilities that need to be entered into, as well as alignment with the respective regulators.”

Decentralised payments

The biggest unanswered industry-wide question is: how are payments going to be organised on decentralised networks? There is no “ultimate solution” so far, explained Wissbach. Bitcoin is not acceptable for institutional clients, there are warning flags over stablecoins and their reserves, and a central bank digital currency (CBDC), such as a “digital euro” seems to be far away.

This has prompted Deutsche Börse to consider falling back on a “trigger” solution, which was successfully tested in early March 2021 along with Germany’s central bank and Finance Agency. It comprises a DvP settlement interface that connects with electronic securities on distributed ledger technology (DLT) and a “trigger chain” linked with TARGET2, the Eurosystem’s large-value payment system. What’s important is that this technological bridge between blockchain and traditional payment systems does not need a CBDC.

From the exchange’s perspective, there are no limitations for any and all of the possibilities to achieve a payment on a distributed network, except in terms of what is acceptable to clients and regulators while also being available for use. “We are not limited to one of those solutions, we could connect to multiple ones, and this is related to where our clients have their liquidity pools. Definitely, a central bank digital currency solution is what we would go for but as long as we don’t have it, we need to look what’s available and we need to use those,” said Wissbach.

Development timeline

Aside from Germany’s eWpG laws, other jurisdictions have or are expecting to pass legislation: Luxembourg’s blockchain act is also applicable for crypto registers, for example. Where there’s likely to be a lot of attention, however, is on the European Union-wide level. A much-anticipated pilot regime for market infrastructures based on DLT is expected to be implemented in early 2023.

The EU Commission proposal is part of a “Digital Finance” package that seeks to boost the potential of innovation and competition while mitigating associated risks, as well as provide legal clarity for crypto asset markets. Permissions granted under the resulting regulation would allow market participants to operate a DLT market infrastructure and to provide their services across all EU member states.

In December 2021, Deutsche Börse established a new central register at the German Central Securities Depository Clearstream, forming the basis for issuance and custody of dematerialized securities compliant with eWpG for the first time in Germany, and linked to TARGET2-Securities, the pan-European securities settlement engine.

In June 2022, Deutsche Börse is expecting to launch the digital instrument including the option to issue into the central register at the CSD next to traditional paper-based rails. It’s expected that over 80% of German securities will be eligible to be digitised as of mid-June 2022, enabling same-day-issuance and paperless, automated straight-through processing. By the end of the year, there’s a plan for a decentralised network solution that will incorporate crypto assets, with further products to be enabled over the course of 2023.

A lot depends on sufficient market support and how the broader ecosystem adapts to these opportunities, Hartung noted: “We expect a fully regulated crypto space to develop that operates within the financial industry. It is existing, it further progresses, and we expect at this stage it is here to stay.”